You’ve painstakingly built your e-commerce dream. Your products are stunning, your website is sleek, and your marketing is on point. But then comes that crucial moment: the customer clicks “Buy Now.” What happens next can make or break the sale. If your payment process is clunky, insecure, or simply doesn’t work for your diverse customer base, you’re leaving money on the table—not just in Nigeria, but globally.

In today’s interconnected digital marketplace the ability to accept payments seamlessly is non-negotiable. Let’s demystify one of the most vital components of any successful online business: the payment gateway. This article will dive deep into understanding payment gateways for e-commerce in Nigeria, highlight their universal importance, and equip you with the knowledge to choose the best online payment processing solution for your business, ensuring you’re ready for global success.

What Exactly is a Payment Gateway?

Imagine a physical store. When a customer is ready to pay, they walk to the cashier, swipe their card, or hand over cash. The cashier processes the transaction, and the money moves from the customer to the business.

A payment gateway is essentially the digital equivalent of that cashier. It’s a secure technology service that authorizes credit card or direct debit payments for online businesses. When your customer clicks “Pay” on your e-commerce site, the payment gateway:

- Encrypts sensitive payment information (like card numbers).

- Sends this data securely to the bank or payment processor.

- Receives approval or denial from the bank.

- Communicates the transaction status back to your website and your customer.

- All of this happens in mere seconds, behind the scenes, ensuring a smooth and secure transaction flow. It’s the silent hero of secure online payments.

Why Payment Gateways Are Absolutely Crucial for Your E-commerce Success

A robust payment gateway isn’t just a convenience; it’s a cornerstone of your online business. Here’s why:

- Enhanced Security & Fraud Prevention: This is paramount. Payment gateways employ advanced encryption and fraud detection tools (like tokenization and 3D Secure) to protect both your business and your customers from cyber threats. This builds immense customer trust.

- Seamless Customer Experience: A smooth, fast, and reliable checkout process reduces friction and minimizes cart abandonment. That frustrating moment when a payment fails? A good gateway helps you avoid it.

- Global Reach & Multi-Currency Support: For businesses in Nigeria looking to sell internationally, a payment gateway that supports multiple currencies and various local payment methods (beyond just cards) is essential for global e-commerce success.

- Increased Conversion Rates: When customers feel confident and the process is easy, they’re far more likely to complete their purchase, directly boosting your online sales.

- Streamlined Operations: Payment gateways automate the entire transaction process, from authorization to settlement, saving you time and reducing manual errors. This is key for e-commerce efficiency.

- Detailed Reporting & Analytics: Most gateways provide dashboards with valuable insights into your sales, transaction history, and customer behavior, helping you make data-driven decisions.

Navigating Payment Gateways in Nigeria:

Nigeria’s e-commerce space is vibrant and dynamic, with unique payment preferences. While credit/debit cards (Visa, Mastercard) are common, other methods hold significant sway:

- Bank Transfers: Direct bank transfers remain a popular and trusted method.

- USSD (Unstructured Supplementary Service Data): For mobile users, especially those without smartphones or internet access, USSD codes allow for quick transactions.

- Mobile Money/Wallets: Growing rapidly, these offer convenient payment options via mobile devices.

- Leading payment gateways in Nigeria like Paystack and Flutterwave have risen to prominence precisely because they understand this local context while offering international capabilities. They integrate these diverse payment methods, allowing businesses to accept payments from customers using their preferred option, whether they are in Lagos, London, New York, etc. They also simplify payment gateway integration for various e-commerce platforms.

- Beyond Nigeria, understanding regional payment preferences is equally vital. In some parts of Europe, direct bank transfers are dominant; in others, specific local card schemes or digital wallets prevail. A truly global e-commerce strategy means your payment gateway must be adaptable.

Key Features to Look for When Choosing Your Payment Gateway

When selecting an online payment processor for your Nigerian e-commerce store (or any global venture), consider these critical factors:

- Supported Payment Methods: Does it offer all the options your target customers use (cards, bank transfers, USSD, mobile money, international cards)?

- Security & Compliance: Is it PCI DSS compliant? What fraud detection tools does it offer?

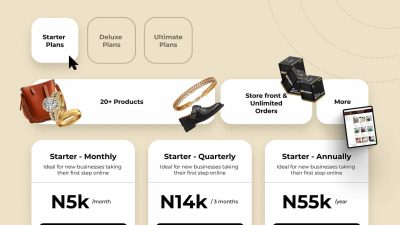

- Pricing & Fees: Understand the transaction fees, setup fees, monthly fees, and withdrawal charges. Compare thoroughly!

- Ease of Integration: How easily does it integrate with your chosen e-commerce platform (Ushoppen, Shopify, WooCommerce, custom site)?

- Payout Speed: How quickly does the money reach your bank account after a transaction?

- Customer Support: Is reliable and responsive support available when you need it?

- Multi-Currency Support: If you plan to sell internationally, this is a must.

- User Experience (UX): Is the checkout flow smooth and intuitive for your customers?

Your Path to Seamless Online Payments & Growth

Choosing the right e-commerce payment solution is a strategic decision that directly impacts your sales, customer satisfaction, and operational efficiency. For Nigerian businesses, leveraging local expertise from providers who understand the unique market dynamics, while also offering global reach, is a powerful combination.

By prioritizing security, convenience, and adaptability in your payment gateway, you’re not just facilitating transactions; you’re building a foundation of trust and efficiency that will propel your business forward, allowing you to confidently serve customers anywhere in the world.

Take the time to research, compare, and choose wisely. Your online store’s success depends on it!

For a deeper dive into eCommerce and online store success, explore our articles here!